WILL CORONAVIRUS CAUSE A GLOBAL RECESSION?

Amid Coronavirus outbreak , stock markets are falling erratically all around the world. Should we fear a global recession?

Asian and European markets nosedived and U.S. markets saw their worst week since financial crisis in 2008.

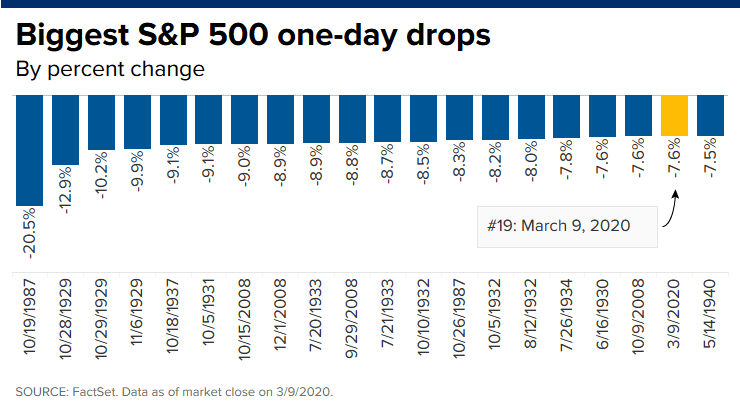

On Thursday alone, the stocks had the worst one-day performance since financial crash of 1987.

The 10-year U.S. Treasury yield, fell below 1% for the first time history. Currently being at 0.82%, an all-time low.

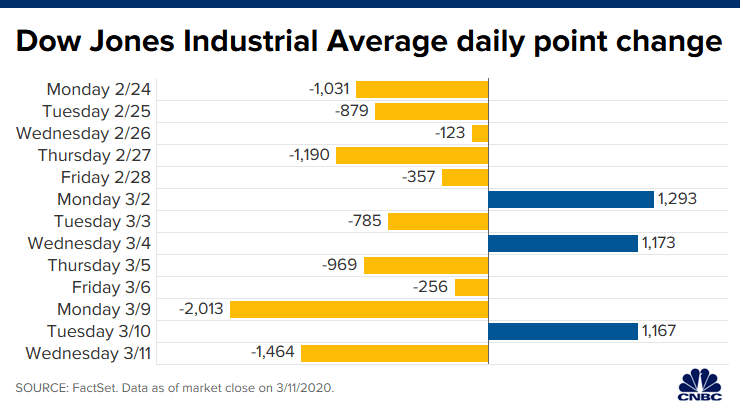

The ‘Dow Jones Industrial Average’ lost more than 2,000 points on Wednesday and again more than 2,300 points on Thursday. Dow Jones, which was in reach of the unprecedented 30,000-point just a few weeks earlier, now stands much closer to where it was on Trump’s election day in November 2016.

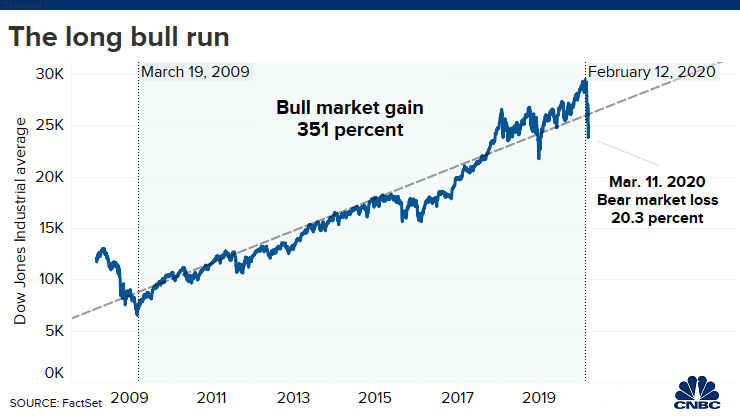

On Wednesday, the Dow ended its historic 11-year bull market run, by plunging 28% and closing in bear-market territory.

A bear market is a condition in which stocks fall 20% or more from recent highs.

The ‘S&P 500’ dropped 26.6% since last month, the ‘Nasdaq 100 index’ fell 24.4%, therefor they also enter in bear-market territories.

Prior to that, on 3rd of March, Federal Reserve decided to make emergency rate cuts for 50 basis points (0.5%) , to mitigate the negative effects of Coronavirus.

The Fed published a statement: “ The fundamental of the U.S. economy remains strong. However, Coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by ½ percentage point.”

But it had the opposite effect, since some perceived this as a panic move and only 15 minutes after The Fed’s announcement, the stocks fell sharply even more.

There has been too much volatility in the market for the last few weeks.

Dow soared more than 1,100 points and other market indexes went up significantly after Joe Biden’s win on Super Tuesday.

But shortly after that, the markets turned bearish again and stocks fell down to record lows.

PRESIDENT TRUMP’S SPEECH

President Donald Trump addressed the nation on Wednesday, in a live speech from Oval Office, in which he announced he was suspending most travel from Europe for 30 days in an attempt to slow the coronavirus pandemic.

Trump also said he will be asking Congress to provide payroll tax relief for Americans and instructing the Small Business Administration to “provide capital and liquidity” for small businesses.

On 12th of March, The Fed announced a major intervention into financial markets, by injecting $1.5 trillion dollars into short-term lending markets.

Some immediately criticized this move, by pointing out that it is not a financial crisis, but a health crisis and cannot be solved by these measures. But the Fed considers liquidity to be a tool to offset the effect of this global pandemic.

The stocks went up sharply the next day; which shows how much uncertainty and volatility there is in the market. Stocks’ surge came at the end of a turbulent week as business leaders pledged to support the U.S. government with virus testing. Dow, S&P, Nasdaq close up more than 9% on Friday.

JOB NUMBERS: BEFORE COVID-19 OUTBREAK IN THE US

The monthly report from the Labor Department was published on March 6, showing that the U.S. economy added 273,000 new jobs in February; well above the expectations of 175,000 new jobs.

The unemployment rate backed down from 3.6% in January to 3.5% in February.

Average hourly earnings rose to $28.52 which is a 0.3% increase over the month.

The healthcare sector led most of the job gains in February. Restaurants and bars added 53000 jobs and government employment increased by 45000.

Few sectors, such as retail, and transportation saw employment recession.

These are the numbers when there was no sign of any impact from the Coronavirus in the U.S. yet.

Strategist are expecting the second and third quarter to take the forceful impact of the hit from the virus spread, intensifying fears of an economic recession.